Financial modelling at Academic research writing services

FINANCIAL MODELLING

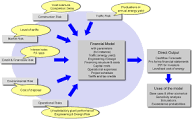

Financial modelling refers to performing a set of calculations or process to analyse the financial information. This process is carried with some pre-decided objective and intentions. Usually it is done to assess performance and financial health of the organization or share and business valuation or capital project analysis or portfolio performance and risk assessment.

Financial modelling can be done with the help of developed software or it can be done manually through excel. The process or fix set of process as may be applicable to the desired objective is already designed and interlinked in the software or excel file for unknown variables. Once variables are inserted into to the model it will facilitate the desired output for intended objective.

Process or set of calculation will depend on various situation and objective and accordingly applicable tools will be used for financial modelling. Like for portfolio performance and risk assessment applicable tools will be CAPM model, Market model, intrinsic / fair value method, α, β, SML, SD, Correlation, covariance, probability etc.fcff_3 oct